Charitable Gift Annuity

Financial security for your lifetime. A legacy for the kingdom beyond your lifetime.

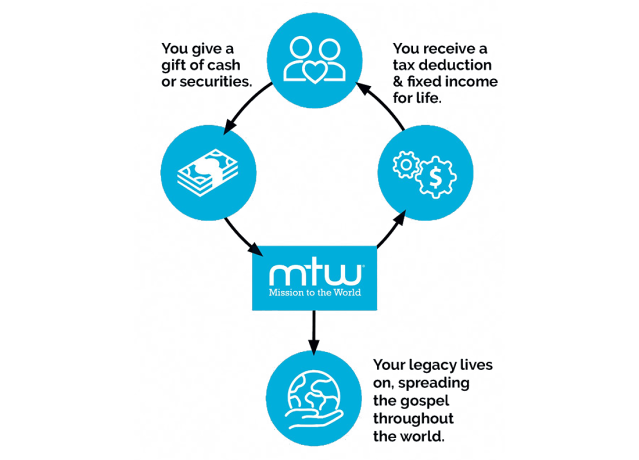

A charitable gift annuity is essentially a planned giving contract between an individual and MTW.

You make a gift to MTW of either a lump sum of cash or appreciated securities such as stocks, CDs, or mutual funds. In return, you receive immediate tax benefits and MTW will pay you a fixed sum for life. Then, at the time of your death, the remainder of the gift goes to MTW, supporting MTW’s work to plant churches and transform communities around the world.

MTW’s Center for Estate and Gift Planning has been offering CGAs for almost 20 years. Many of our annuitants have established a second CGA with us because their first annuity met their need for income while supporting missions.

Current Rates of Return (%)

Age | One-Life | Two-Life |

65 | 5.7% | 5.0% |

70 | 6.3% | 5.5% |

75 | 7.0% | 6.2% |

80 | 8.1% | 6.9% |

85 | 9.1% | 8.1% |

90 | 10.0% | 9.8% |

Rates are as of January, 2024, AFR used is 5%. MTW offers the rates recommended by the American Council on Gift Annuities.

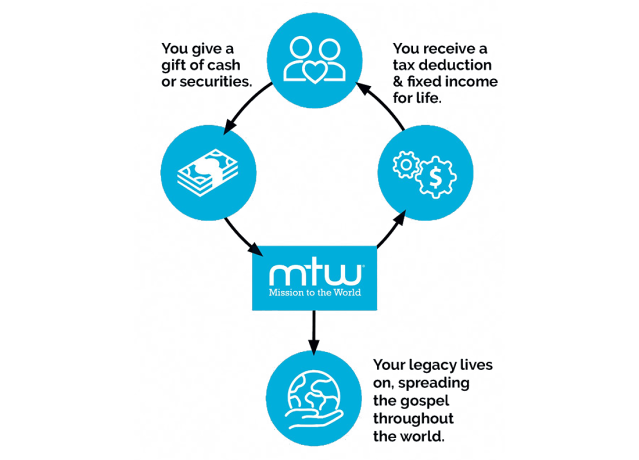

A charitable gift annuity is essentially a planned giving contract between an individual and MTW.

You make a gift to MTW of either a lump sum of cash or appreciated securities such as stocks, CDs, or mutual funds. In return, you receive immediate tax benefits and MTW will pay you a fixed sum for life. Then, at the time of your death, the remainder of the gift goes to MTW, supporting MTW’s work to plant churches and transform communities around the world.

MTW’s Center for Estate and Gift Planning has been offering CGAs for almost 20 years. Many of our annuitants have established a second CGA with us because their first annuity met their need for income while supporting missions.

Current Rates of Return (%)

Age | One-Life | Two-Life |

65 | 5.7% | 5.0% |

70 | 6.3% | 5.5% |

75 | 7.0% | 6.2% |

80 | 8.1% | 6.9% |

85 | 9.1% | 8.1% |

90 | 10.0% | 9.8% |

Rates are as of January, 2024, AFR used is 5%. MTW offers the rates recommended by the American Council on Gift Annuities.

Are CGAS For You?

APPRECIATED SECURITIES

If you have appreciated securities that you want to dispose of, such as assets that are not yielding much income, CGAs may be right for you.

FUNDING

CGAs can be funded with cash or securities.

GOOD RATE OF RETURN

CGAs have a good rate of return. If you have a low interest rate investment, such as a CD, CGAs may be right for you.

SECURE

CGAs are very secure: annuity payments are a fixed asset, backed by the full resources of MTW.

How Does a Charitable Gift Annuity Work?

How Does a Charitable Gift Annuity Work?

Case Study

Mrs. Robbins is an 80-year-old widow. She had a $10,000 certificate of deposit (CD) that provided her with a 2% return annually. Mrs. Robbins established an MTW annuity with the $10,000 and now receives:

- A rate of return of 8.1% based on her age.

- Annual payments of $810 of which $586 is tax-free.

- A charitable income tax deduction of $4,485.

- An effective rate of return of 11.2% because a portion of her payment is tax-free.

- A lasting gift to missions.

Case Study

Mrs. Robbins is an 80-year-old widow. She had a $10,000 certificate of deposit (CD) that provided her with a 2% return annually. Mrs. Robbins established an MTW annuity with the $10,000 and now receives:

- A rate of return of 8.1% based on her age.

- Annual payments of $810 of which $586 is tax-free.

- A charitable income tax deduction of $4,485.

- An effective rate of return of 11.2% because a portion of her payment is tax-free.

- A lasting gift to missions.

Apply for a gift annuity today

or contact us to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Apply for a gift annuity today

or contact us to schedule a FREE personal and confidential review of your current estate plan from a stewardship perspective.

You can reach us at 678-823-0028 or [email protected]

Featured Stories

Walking With Church Planters in West Africa: A Vision Trip That Led to Impact

The spirit of humility and sacrifice among the church planters and young men being trained really struck me. I knew I wanted to do more.

Making Disciples: Training Up the Next Generation of Spiritual Givers

Those of us with the spiritual gift of giving are also called to play our role in making disciples—disciples who have the gift of giving.

Cutting the Coal: One Man’s Lifelong Call to Missions

As a teacher, he supported over 30 missionaries. As a missionary, he served the unreached in the jungle. Now 97, his stewardship continues.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.

BACK TO ESTATE & GIFT PLANNING

This website is for informational purposes only and is not intended to be legal, tax, or financial advice. Please consult your legal and tax advisors to verify its applicability to your specific circumstances.